1.Digital payments

1.1What is Digital Payment?

Digital payments are payments through online mode or digital mode without cash. It can definition the transfer of value from one payment account to another account where both of payers/payee are using digital device such as mobile phone, credit, debit or prepaid card.

1.2 Overview of Digital Payment

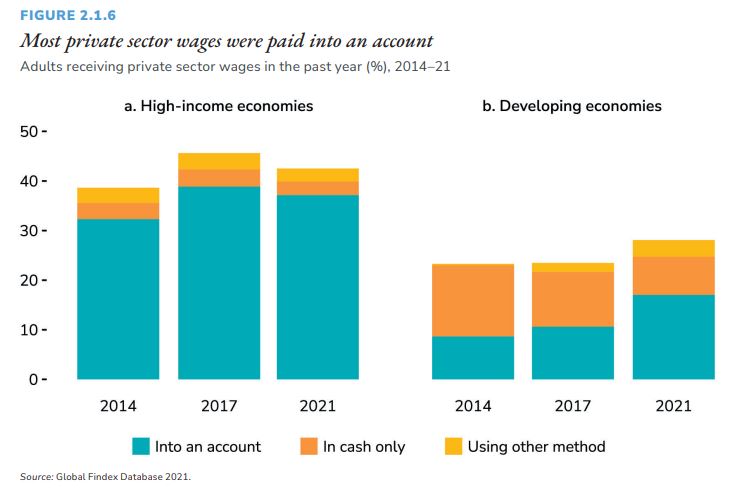

Globally, 31 percent of surveyed adults received at least one wage payment from a private sector employer— 43 percent in high-income economies and 28 percent in developing economies. In high-income economies, 87 percent of wage earners received their wage payments into an account (a share that has remained steady over time), compared with 61 percent in developing economies—an increase from just 37 percent in 2014 and 45 percent in 2017 (figure 2.1.6).

• The share of adults making or receiving digital payments in developing economies grew from 35 percent in 2014 to 57 percent in 2021—an increase that outpaces growth in account ownership over the same period.

• Thirty-nine percent of adults in developing economies—or 57 percent of those with a financial institution account—opened their first account at a financial institution specifically to receive a wage payment or money from the government.

• Twenty percent of adults living in developing economies, excluding China, made a merchant payment using a card, mobile phone, or the internet—and about 40 percent of them did so for the first time after the start of the pandemic. About one-third of adults in developing economies who paid a utility bill directly from an account did so for the first time after the start of the COVID-19 pandemic—evidence of the role of the pandemic in accelerating digital adoption.

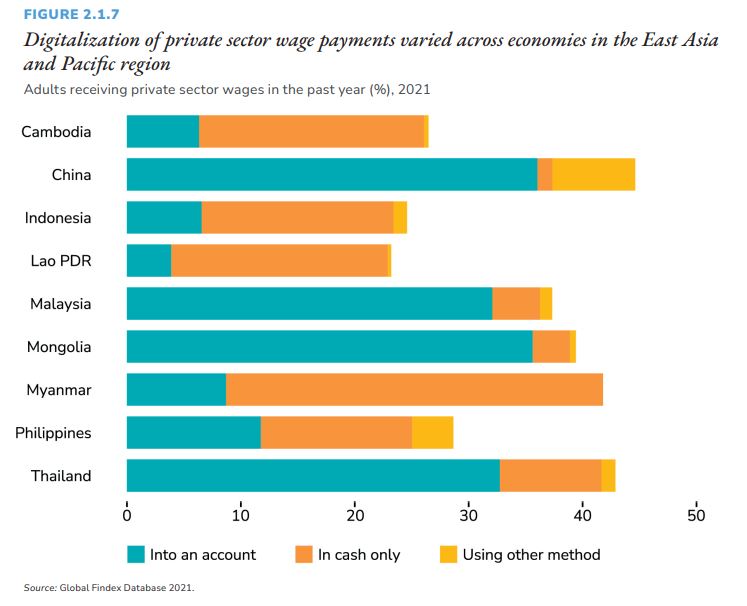

These averages mask large variations among developing economies, both in the share of adults receiving private sector wage payments and in how they receive these payments. Although some economies have achieved levels of digitalization of private wage payments comparable to those in high-income economies, others still have room for growth. Consider economies in the East Asia and Pacific region. In China and Thailand, two upper-middleincome economies, about 45 percent of adults received a private sector wage payment, and the vast majority

(about 80 percents) received it into an account. In Cambodia, Indonesia, the Lao People’s Democratic Republic,and the Philippines, all lower-middle-income economies, about a quarter of adults received a private sector wagepayment, with the share of wage earners receiving the payment into an account ranging between 17 percent inLao PDR and 41 percent in the Philippines (figure 2.1.7).

1.3 Payment Gateway Market Overview

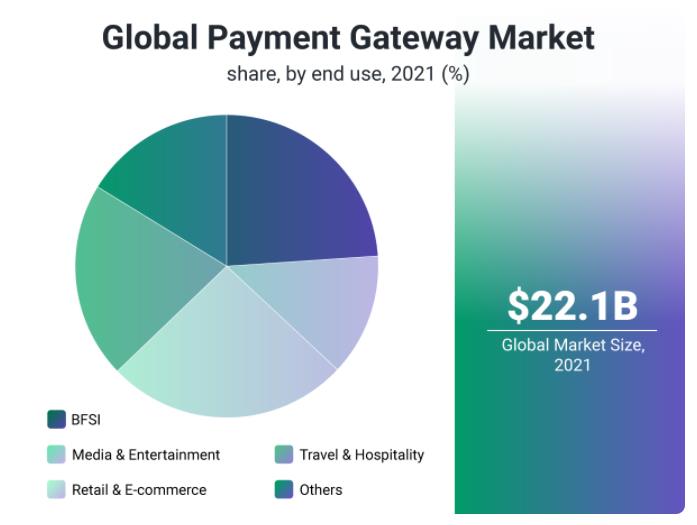

In 2021, the global payment gateway market size was valued at $22.09 billion USD, and is expected to expand at a compound annual growth rate (CAGR) of 22.1% from 2022 to 20301.

Payment gateways like Amazon Pay, Apple Pay, Samsung Pay, and Android Pay have made the process of bill payments and online purchases even more easy and convenient. The shift in merchant and consumer preference for digital payments and money transfers has influenced various companies to expand their payment systems and will continue to propel the growth of payment gateways in the upcoming future.

1.4 What is a Payment Gateway?

Payment gateway is the system that allows your website to collect credit and debit card payments. It serves as the go-between for the customer, business, and payment processor. The banks or finance systems need to compliant with PIC requirements and the latest anti-fraud legislation when creating your own payment gateways.

1 .5 How to create a payment gateway

- Create your payment gateway infrastructure.

- Choose a payment processor.

- Create a customer relationship management (CRM) system.

- Implement security features.

- Apply for a 3DS certification from EMV (Europay, Mastercard, Visa).

1.6 Pros and Cons when creating payment gateway

Pros:

- Lower monthly and per-transaction fees over time

- Full control over payment processing

- The ability to create your own custom features

- You can sell your payment gateway services to other companies for additional revenue

Cons

- Considerable set-up costs including all required certifications, developer fees, and audits

- Lengthy set-up time between development UX testing, and ongoing maintenance

- Requires more manpower than an out-of-box solution

- Responsibility for security falls solely on your shoulders

1.7 Payment Process Flow

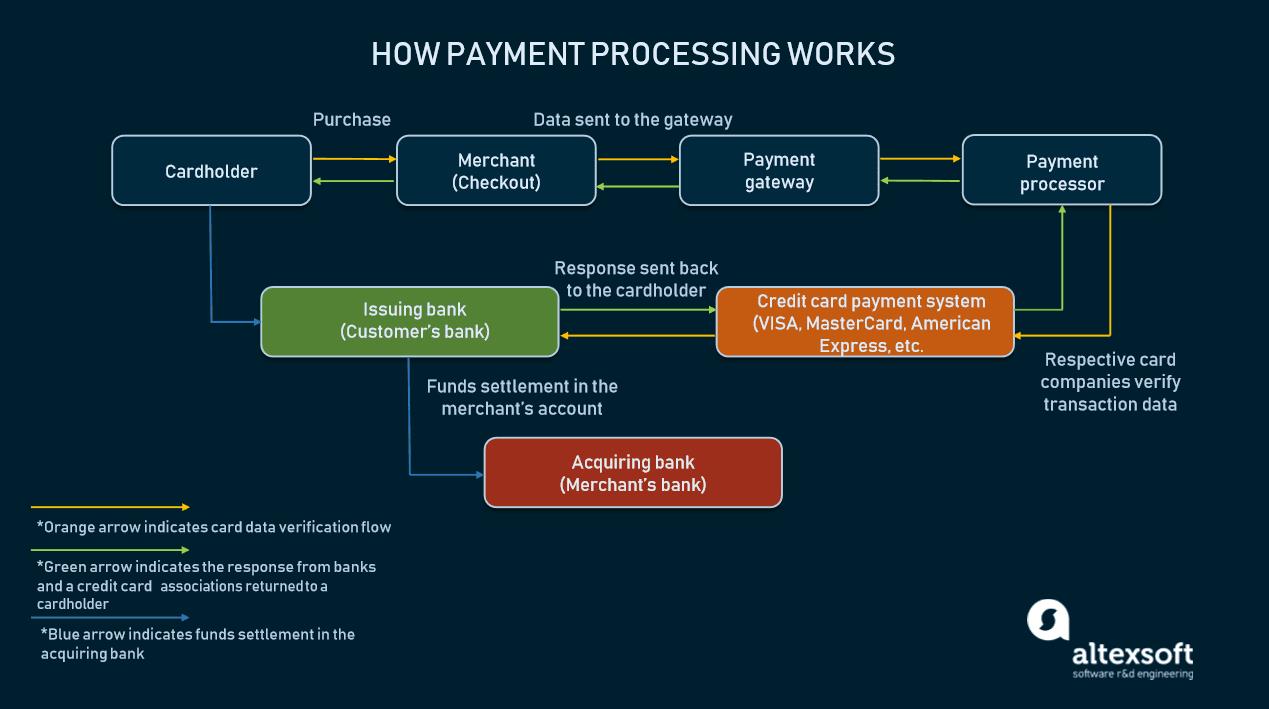

The infrastructure of online payment processing is a little bit more complicated than you might imagine. For the customer, it’s represented by a small window, or a separate website, where they have to pass through the checkout. But actually, processing involves several financial institutions, or tools, verifying the transaction data on both ends, allowing the customer to complete the purchase in a few seconds.

When a customer checks out – passing the card number, expiration date, and CVV – a payment gateway has to perform several tasks, which take about 3-4 seconds:

- Customer. A customer presses a “Purchase” button and fills in the necessary fields to pass the transaction data. The data is encrypted and sent to the merchant’s web server via an SSL connection.

- Merchant and payment gateway. After the transaction data is received, a merchant passes it to the payment gateway via another encrypted SSL channel. If any of data is stored by a payment gateway, it is settled in a specific type of secured storage. Usually, gateways don’t store actual credit card numbers, but rather save tokens.

- Payment processor. The information goes to payment processors. These are the companies that provide payment processing services as third-party players. Payment processors are connected both with a merchant’s account and a payment gateway, transferring data back and forth. At that stage, a payment processor is passing the transaction to a card network (Visa, Mastercard, American Express, etc.).

- Visa/Mastercard/American Express/Discover. The role of a card network is to verify the transaction data and pass it to the issuer bank (the bank that produced the cardholder’s credit/debit card).

- Issuer bank. The issuer bank also accepts or denies the authorization request. In response, a bank sends a code back to the payment processor, which contains the transaction status or error details.

- Payment gateway. Transaction status is returned to the payment gateway then passed to the website.

- Customer and issuing bank. A customer receives a message with the transaction status (accepted or denied) via a payment system interface.

- Issuer bank. Within a couple of days (generally the next day), the funds are transferred to the merchant’s account. The transaction is performed by the issuing bank to the acquiring bank.

-

1.8 How does an online payment system work?

The customer initiates the transaction at a POS or terminal. The merchant bank obtains information from the card or digital wallet and forwards it to the payment gateway, which encrypts these sensitive details before transferring it to the card issuer for processing.

Once the payment processor (often under the control of the card issuer) receives the request, it goes through a series of authorizations to confirm if the transaction details from the source match the destination account (merchant account) details. The payment processor also verifies the bank account balance before authorizing or declining the transaction.

If the processor approves the transaction, the acquiring bank will receive the approval to release or accept funds for the transaction.

|

1. Customer initiates a digital purchase.

2. The merchant transmits the cardholder information to the payment gateway.

3. The payment gateway encrypts the cardholder information and transmits it to the payment processor.

4. The payment processor verifies the cardholder information and transmits it to the card network.

5. The card network transmits the information to the issuing bank.

6-9. Depending on the amount of funds in the cardholder’s account, an approved or declined message is transmitted back along the payment network.

10. If the payment is approved, funds are transmitted to the merchant’s account at their acquiring bank.

|

1.9 Benefits of building custom payment gateways

- When you create a payment gateway in-house, you save on development costs and subscription fees.

- Custom gateways allow you to modify the infrastructure to suit your business needs. For instance, you can add extra verification modules to boost the security of the system infrastructure.

- You can sell the custom gateway as a white-label solution to other companies.

- Custom payment systems are more versatile because they allow multi-currency transactions.

- Since you don’t rely on third-party apps, you’ll end up paying less in fees for the gateway solution, which means more profits.

Owners of accounts—whether those accounts are with a bank or regulated institution such as a credit union, microfinance institution, or mobile money service provider—are able to store, send, and receive money, enabling the owners to invest in health, education, and businesses.

- to, Worldwide, account ownership increased by 50 percent in the 10 years spanning 2011 to 2021, to reach 76 percent of the global adult population.

• From 2017 to 2021, the average rate of account ownership in developing economies increased by 8 percentage points, from 63 percent to 71 percent.

• Mobile money is driving growth in account ownership, particularly in Sub-Saharan Africa, where 33 percent of adults have a mobile money account.

• Recent growth in account ownership has been widespread across dozens of developing economies. This geographic spread is in stark contrast to that from 2011 to 2017, when most of the newly banked adults lived in China or India.

• The gender gap in account ownership across developing economies has fallen to 6 percentage points from 9 percentage points, where it hovered for many years.

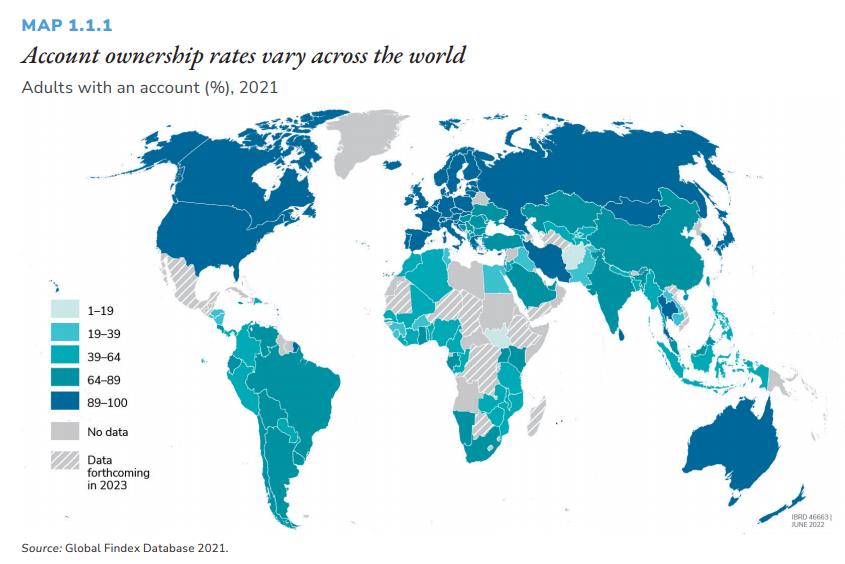

The data also show significant differences in account ownership rates across economies in the same income group (figure 1.1.1). For example, among low-income economies account ownership varies from 6 percent in South Sudan to 66 percent in Uganda. Among high-income economies, Uruguay has the lowest account ownership rate at 74 percents, and 10 high-income economies have 100 percent account ownership. Thailand boasts the highest account ownership rate among upper-middle-income economies at 96 percent. And in lower-middle-income economies, account ownership ranges from 21 percent in Pakistan to 98 percent in Mongolia.

References Documents:

https://www.worldbank.org/en/publication/globalfindex/brief/the-global-findex-database-2021-resources#4

https://www.altexsoft.com/blog/business/payment-gateway-integration/

https://softjourn.com/insights/how-to-build-your-own-payment-gateway

https://anywhere.epam.com/business/how-to-build-a-payment-system

About me -Hoa: I am PO (Product Owner) in Finance Company in Sai Gon Viet Nam. I am so happy when collecting and searching about this knowledge. It is also base on my little experience in Finance field.

Đang xử lý....

Đang xử lý.... Đang xử lý....

Đang xử lý....