PAYMENT PROCESSING SERVICES (PP) – Part 2

Contents

1. Merchant Account 2

1.1 What is a merchant account?. 2

1.2 Why do I need to set up a merchant account for small businesses?. 2

1.3 How to set up a merchant account for small businesses. 2

1.4 How to create a merchant account?. 2

1.5 Types of Merchant Account. 3

1.5.1 Aggregated Merchant Account. 3

1.5.2 Dedicated merchant accounts. 3

1.5.3 High-risk merchant accounts. 4

1.6 How do merchant accounts work?. 4

2. Type of Cards. 5

2.1 Low-interest and balance transfer cards. 5

2.2 Rewards credit cards. 6

2.2.1 Travel credit cards. 6

2.2.2 Cash back credit cards. 6

2.2.3 Credit-building cards. 6

2.2.4 Business credit cards. 7

2.2.5 Store credit cards. 7

2.2.6 Charge cards. 7

2.2.7 Other types of cards. 8

3 Payment methods. 8

3.1 Reasons why people choose payment methods are. 8

3.2 What’s available to your customer?. 8

3.3 Payment preferences in 2021. 9

3.3.1 Payment preferences in the US. 10

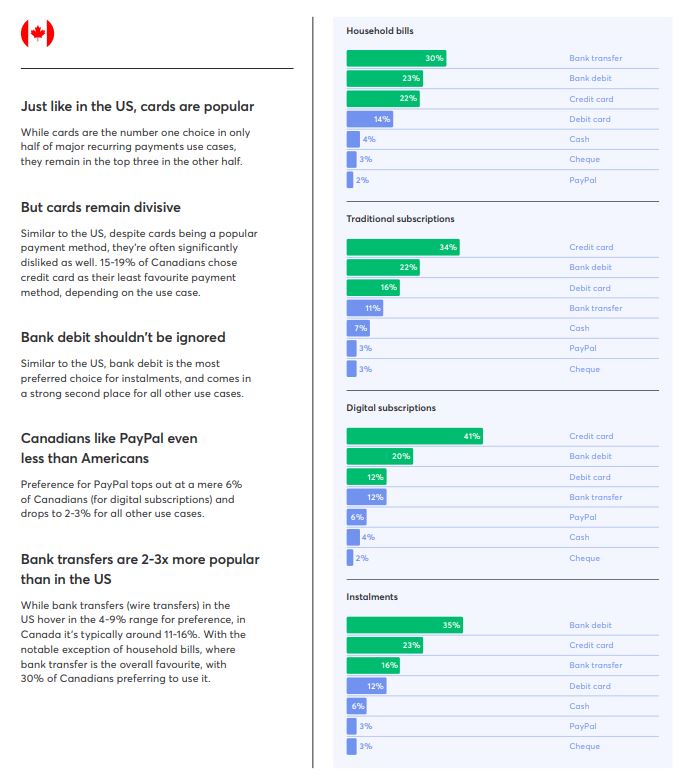

3.3.2 Payment preferences in Canada. 11

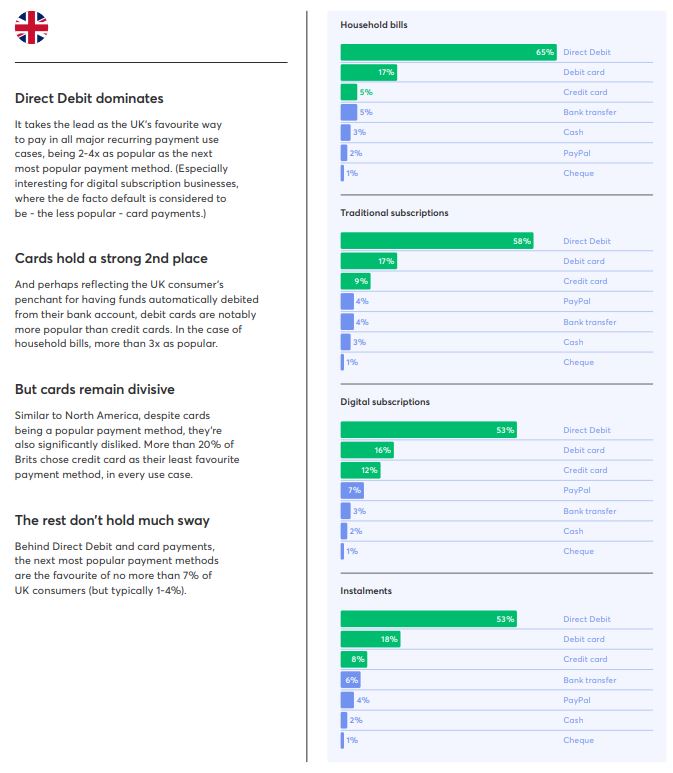

3.3.3 Payment preferences in the UK.. 12

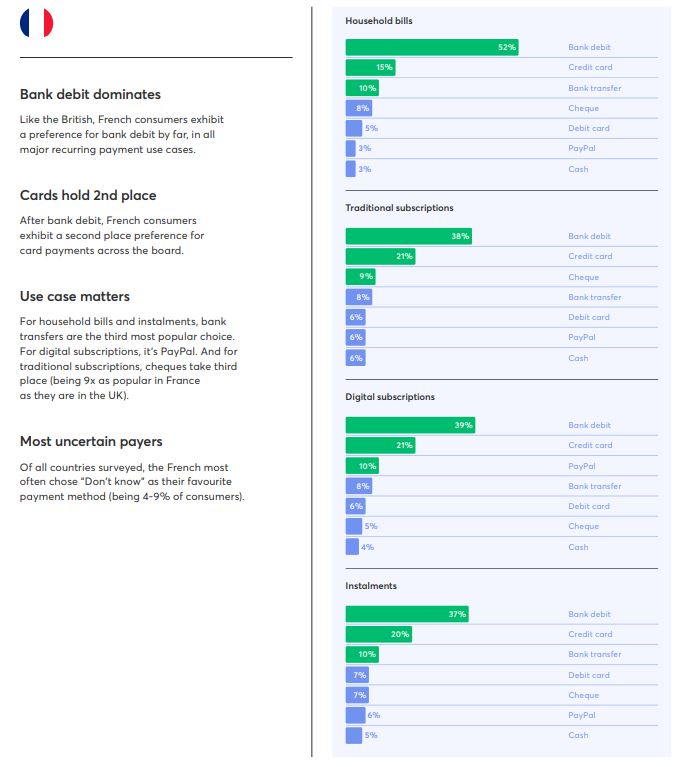

3.3.4 Payment preferences in the France. 13

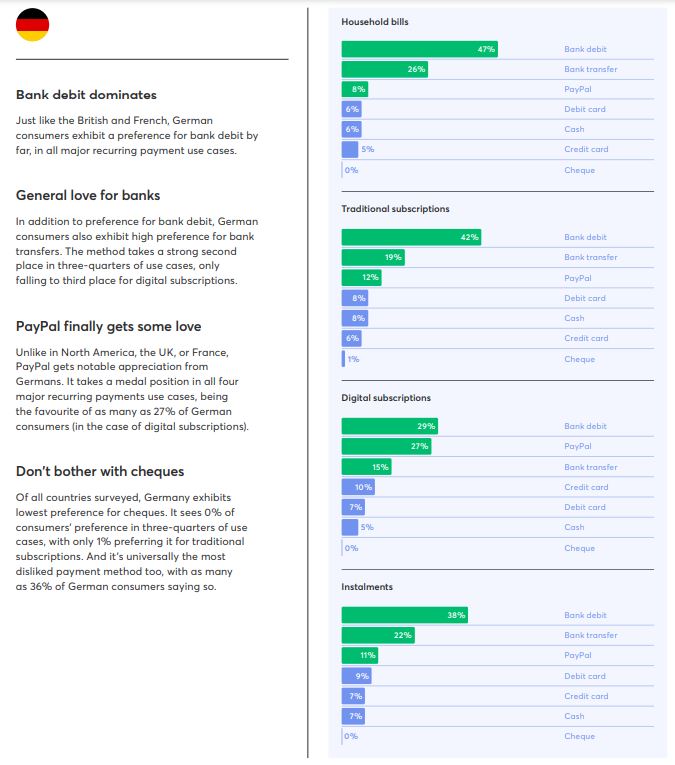

3.3.5 Payment preferences in Germany. 14

3.3.6 Payment preferences in Australia. 15

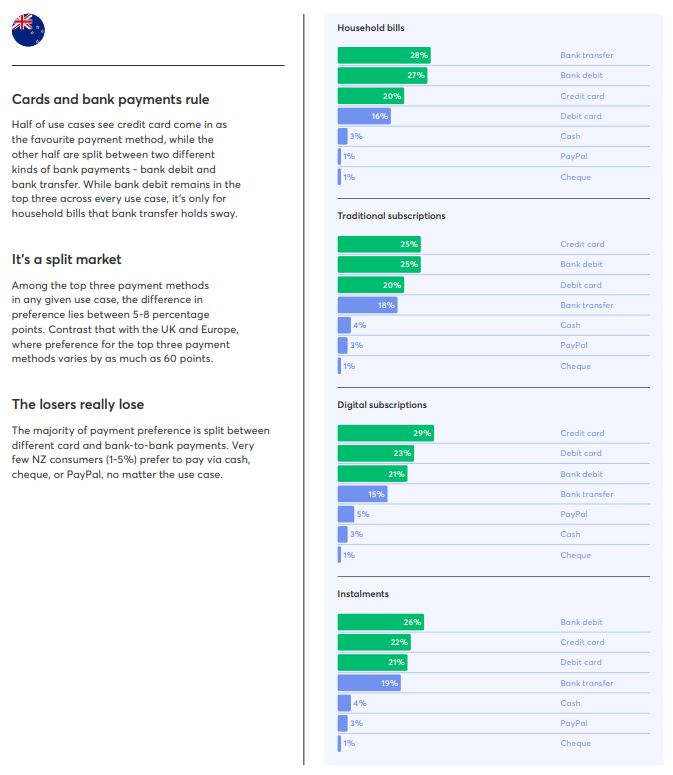

3.3.7 Payment preferences in New Zealand. 16

3.3.8 How does this change for the most popular payment methods?. 16

3.4 How do online payments via Credit Card or Debit Card work?. 17

3.5 Clearing and settlement step-by-step. 19

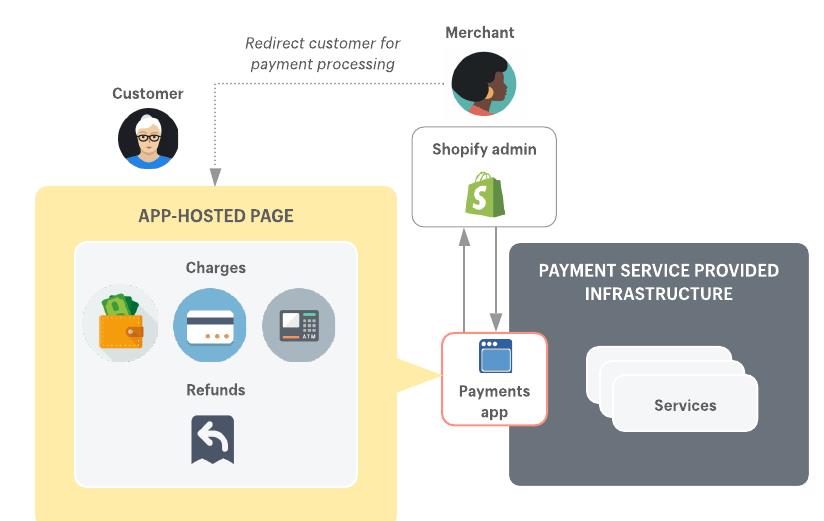

3.6 How payments apps work (example: shopify). 20

References: 21

A merchant account is a type of bank account into which funds from debit and credit card purchases are transferred after they have been processed. It’s a very important part of the payments process when allowing transactions smoothly, buying at online store.

As a small business owner, you should try to accept as many forms of payment as possible. With a merchant account, you’ll be able to accept online credit and debit card transactions as well as in-house card payments. In addition, there are merchant accounts that offer services to ensure your account remains PCI DSS compliant, helping you keep your customers’ transaction data safe and secure.

It is not difficult to open a merchant account, but be sure to do your research into who is the best provider for your small business. Each provider will have their own features, pricing schedules, and contract terms. Make sure you pay attention to how much you will be charged, and compare the services offered by different providers.

-To open a merchant account, providers should:

- Know the nature of your business, what you are selling and how you will sell it.

- Calculate the monthly turnover for card payments and try to estimate if yours is a new company.

- Analyze the transaction size.

- Opening a merchant account isn’t too complicated but it’s quite easy to make mistakes that may cost you some or even a lot of money if you fail to manage it in a proper way.

Therefore, it’s essential to do some deep research before choosing any merchant service provider. Like in any other field, each merchant provider has its own features, price schedules, and contract terms so make sure you didn't miss out on anything before being committed to their services.

- Normally, most providers are more suitable for big businesses since small business owners often find it hard to pay high rates and fees for a long time and when it happens the only way out is to pay an expensive penalty to break the contract.

What’s worse is that most providers will offer you a 3-year contract that has an automatic renewal clause. It means that the contract will be renewed for one or two-year periods after the end of the previous term. In the case of closing your account early, it could cost you an early termination fee (ETF).

An aggregated merchant account is basically a merchant account that’s shared between several merchants. Instead of each merchant having their own individual merchant account, all their transactions are paid into one shared account. Once a customer’s payment has arrived in the aggregated merchant account, the account provider transfers the money to the merchant’s individual business account.

The main disadvantage of an aggregated merchant account is control. With an aggregated account, your money is at the whim of your account provider. If they want to hold money for five days before paying it to you, they can do that.

The pay-off for losing control is access. It’s substantially easier for merchants to open an aggregated merchant account than a dedicated one. While there are checks involved with aggregated accounts, the process is much quicker and easier than with dedicated accounts.

Dedicated (Authorize.net, PayLeap)

- More in depth credit check and underwriting process

- Can negotiate better rates

- More control over when money gets transferred out of the account

Dedicated merchants accounts are opened exclusively for one merchant. Since the account is opened specifically for your business, you can usually negotiate payment processing fees based on your monthly debit and credit card transaction volume.

While dedicated merchant accounts give you more control over your money and attract lower card processing fees, the application process is longer and harder to complete successfully. Before you can open a dedicated merchant account, your service provider will perform a detailed credit check and follow a thorough underwriting process. This can take a long time to complete, especially if you have to provide hard copies of banking info, accounts or other business records.

Aggregate (Stripe, PayPal)

- Application process is much simpler and faster

- Less control over the account

- Can’t negotiate the rates

- A high-risk merchant account is a payment processing account that is considered “high-risk” to the banks because it’s prone to fraudulent sales and chargebacks. One of the most common drawbacks of high-risk merchant accounts is that they may require you to pay higher fees and processing rates.

- But one good thing about being a high-risk merchant is that you will be able to accept transactions in multiple currencies and sell to customers outside the country, this means you have a chance to access larger markets and grow your business faster. Besides, the high chargeback fees also mean your merchant account gets better protection.

- Some popular high-risk merchant account providers: Zombaio, Verotel, Instabill

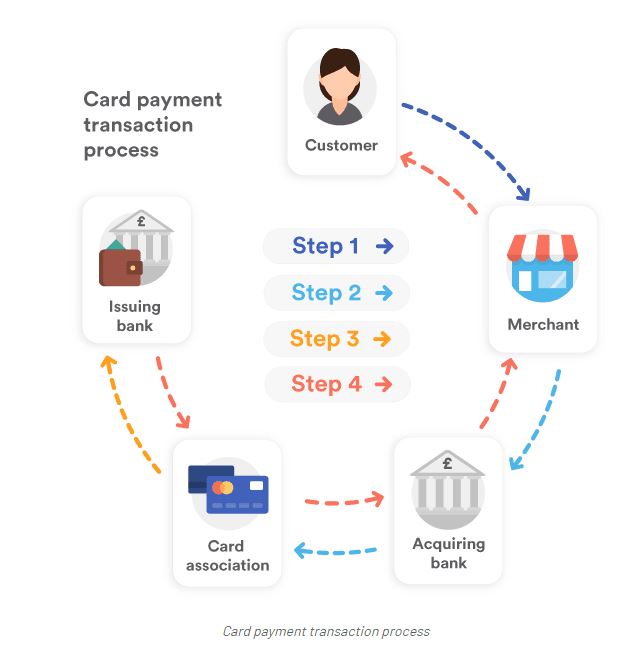

To sum up the process of how a merchant account works, look at what happens below when a customer - We’ll call her Julia - makes a payment via her card in a coffee shop.

- Taking payment

- Processing payment

- Receiving payment

- Step 1: Julia orders a cup of coffee and gives her card to the cashier. The cashier then put her card into the card reader to start the payment process.

- Step 2: The details of Julia’s card along with the details of the transaction will be sent from the card reader to the acquiring bank.

- This acquiring bank will track this information to the relevant card association (Visa card, Mastercard..)

- Step 3: Julia’s card then forwards the transaction details to the issuing bank (which the bank Jane registered her visa) to check whether Julia has enough money in her bank account to pay for her bill

- Step 4: The transaction would be successful if Julia has enough money for the order. The issuing bank will respond back to the acquiring bank, via the relevant card association and finally send a notification to the card reader “Transaction Approved”. At this step, Julie already made a successful payment via her Visa card.

- So, you can think of a merchant account as a secure place for funds to sit while the bank can check all the necessary factors to make a payment as well as ensure the customer has enough money in their account to pay for their orders.

- At the point Julia enjoys her coffee you will not have Julia’s money yet but it’s perfectly normal. It may take anywhere between 24 hours and seven days to actually get transferred. This process is known as the “settlement period” and it varies among providers although most top merchant account providers will make sure you get the money into the business bank account within three working days.

Balance transfer credit cards

A credit card with a 0% APR (for 15 to 21 months) can save you money by directing all of your payments toward reducing the principal balance rather than diverting some to pay interest charges. Most cards charge an upfront balance transfer fee of 3% or 5%, but some credit cards have no balance transfer fee. Some examples of balance transfer credit cards are Bank of America Customized Cash Rewards credit card, Citi Rewards Card, and Wells Fargo Cash Wise Visa card. Many credit cards also offer 0% intro APR on purchases for a limited time, usually up to 18 months.

These types of credit card options include the Citi Diamond Preferred Card, the Citi Double Cash Card, and the U.S. Bank Visa Platinum Card.

Travel credit cards allow you to earn miles or points on purchases that you can redeem for free flights, hotels, and other travel expenses. Some travel rewards credit cards may provide additional benefits and perks, such as airport lounge access, sign-up bonuses in points or miles, and free checked bags. Travel cards are classified into general travel cards (such as the Capital One Venture Rewards Credit Card) and co-branded cards (The Delta SkyMiles Gold American Express Card).

They can assist you in simplifying your finances, earning rewards on spending, and taking advantage of additional benefits that debit cards do not provide. Cash back cards can earn flat-rate, tiered, or rotating bonus rewards. Some cash back credit cards: 0-annual-fee Wells Fargo Active Cash℠ Card, American Express Blue Cash Preferred® Card, or Chase Freedom FlexSM Card.

- Student credit cards

A student credit card can provide:

Financial education and resources are available online, via apps, or by phone.

Assistance in developing good payment habits through alerts and reminders from your credit card issuer.

- Cash back and other student-specific rewards.

The Discover it® Student chrome, for example, has no FICO credit history requirement and offers ongoing rewards.

- Secured credit cards

A secured credit card needs a cash security deposit when the account is opened. The deposit, which is usually equal to your credit limit, reduces the risk to the credit card issuer.

If you want to start with a secured credit card, the Discover it® Secured Credit Card is a good option.

- Alternative cards

+ Alternative payments are convenient, inexpensive, and efficient. Card payments have two major advantages: authorization (guaranteed funds to the merchant) and payment speed.

+ Alternative cards, which are now available from many issuers, consider factors other than credit scores during the approval process. This is easier for those with no credit history to apply and be approved.

+ An example of an alternative card is the Petal® 2 “Cash Back, No Fees” Visa® Credit Card.

A business credit card is a credit card that is intended for use by a business rather than for personal use. Businesses of all sizes can apply for business credit cards, which can help them build a credit profile and improve future borrowing terms. Small business credit cards give owners of small businesses easy access to a revolving line of credit with a set credit limit, allowing them to make purchases and withdraw cash. Furthermore, a sound business credit card will help you benefit from your daily spending and make running your business easier. Interest rates on these credit cards are typically slightly higher than those on traditional loans. This is because credit card debt is generally unsecured, which puts lenders at a higher risk. Cash back credit cards, typical rewards credit cards, travel credit cards and even secured credit cards can be used for business purposes. Examples of business credit cards include the American Express Blue Business® Plus Credit Card, the Ink Business Unlimited® Credit Card, and the American Express Blue Business CashTM Card.

Store cards or retail cards are credit cards that can only be used at specific locations. Customers can obtain these revolving lines of credit from retailers who work with banks. Store cards encourage customers to buy items on credit today and pay them off later. Using a store credit card in the store with which it is associated may earn you more rewards than using a traditional rewards credit card in the same store. Furthermore, some store cards include additional benefits such as discount coupons and event invitations. Like any other credit card account, store cards can help you build credit over time if used responsibly. Moreover, these cards can be “open-loop,” which means they can be used anywhere, or “closed-loop,” which can only be used at the retailer in question. For example, you cannot use your closed-loop Target REDcard Credit Card at the local gas station.

A charge card is a kind of electronic payment card that does not charge interest but requires you to pay the statement balance in full every month. A small number of issuers provide charge cards. They have an uncapped spending limit and generous reward benefits for cardholders, but they usually have a high annual fee.

- Cards for kids

Prepaid cards are a good option for your child in an emergency, or you can add your child’s name as an authorized user to your current credit card account. Moreover, if your child is 18 or older, you can also assist them in applying for their credit card, thereby helping them build credit while also providing them with a convenient way to pay.

Greenlight is a debit card for children that includes many parental controls. Parents can use the Greenlight app to instantly transfer funds to their children’s accounts, set spending limits, receive transaction alerts, turn cards on and off, etc.

- Prepaid cards

A prepaid card functions similarly to a gift card in that it allows you to spend the amount of money available on the card. Banks issue prepaid debit cards branded by major credit card companies such as Visa, MasterCard, Discover, and American Express. Prepaid cards are a good choice for people who do not have credit cards. They may appear less risky than traditional credit cards or even debit cards.

- Virtual cards

A “virtual card” is stored on your mobile phone and can be used to make contactless payments in stores or online, but it has its card number, expiry date, and CVC. Virtual cards function exactly like physical bank cards; they reside in your phone’s digital wallet rather than your physical wallet. Thanks to encryption, they provide a safe and convenient way to pay online and in-store. Virtual cards are available from various providers, including Citi cards and Capital One’s Eno program. You can also use third-party services like Privacy to generate a virtual card number for an existing account.

- Easiest to use: Selected by 56% of consumers

- Automatic: Selected by 42% of consumers

- Commonly accepted: Selected by 35% of consumers

Cash, debit cards, bank accounts. Unsurprisingly, these top the list of payment methods consumers have available to them right now.

|

#

|

Consumers prefer it because...

|

Automatic

|

Easiest to use

|

Commonly accepted

|

Payment is instant

|

Gives points, cash back, or other rewards -

|

|

1

|

Bank debit

|

Knowing payment will be taken automatically gives peace of mind (66%).

|

It takes fewer steps or less time to complete payment (64%).

|

The payment method is accepted by most or all businesses the consumer purchases from (32%).

|

|

|

|

2

|

Debit card

|

|

It takes fewer steps or less time to complete payment (57%).

|

The payment method is accepted by most or all businesses the consumer purchases from (39%).

|

Rather than taking a few days to process (41%).

|

|

|

3

|

Credit card

|

|

It takes fewer steps or less time to complete payment (53%).

|

The payment method is accepted by most or all businesses the consumer purchases from (42%).

|

|

(41%).

|

|

4

|

Bank transfer

|

Knowing payment will be taken automatically gives peace of mind (35%).

|

It takes fewer steps or less time to complete payment (54%).

|

|

Rather than taking a few days to process (36%).

|

|

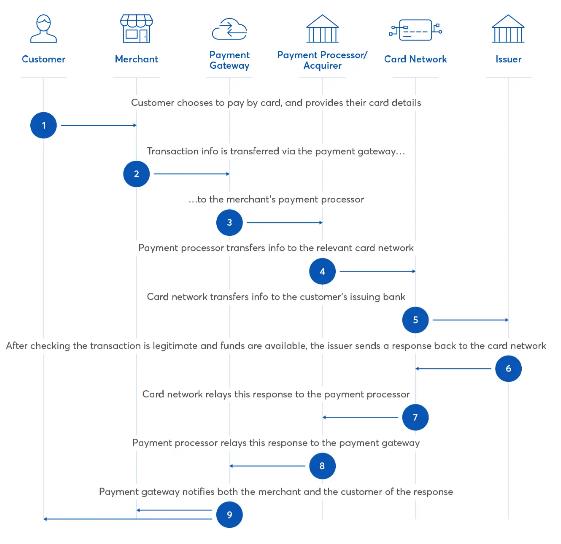

The process for businesses to accept credit or debit card payments online from customers involves several entities and many steps. Before we explore these in further detail, let’s briefly define some key terms:

Merchant account - A specific type of bank account required for a business to accept credit or debit card payments from customers.

Issuer (A.K.A. issuing bank) - A financial institution that provides credit or debit cards to its customers. In the context of this guide, think of it as the customer’s bank.

Card association (A.K.A. card network) - A collection of member financial institutions that process card payments based on an agreed set of rules. Major examples are Visa and Mastercard.

Acquirer (A.K.A. acquiring bank or merchant bank) - A financial institution that processes a transaction based on information from the issuer and card association. They provide businesses with merchant accounts, and are licensed members of card associations.

Payment processor - A term often attributed with varying definitions. In the context of this guide, a payment processor is the facility of an acquirer which transfers transaction details to the relevant card association.

Payment gateway - Software that facilitates the transfer of a customer’s card details from a merchant’s website to a payment processor.

3.2.5 Authorisation step-by-step

|

1. - The customer completes the merchant’s checkout process and elects to pay via credit or debit card, submitting their card details.

2. - The merchant securely transfers the transaction information (including these card details) to their payment gateway.

3. - The payment gateway securely transfers the transaction information to the payment processor used by the merchant’s acquiring bank.

4. - The payment processor securely transfers the transaction information to the card association.

5. - The card association securely transfers the transaction information to the customer’s issuing bank, which checks there are sufficient funds to complete the transaction, and also runs checks to ensure the transaction is not fraudulent.

6. - The customer’s issuing bank submits a response to the card association, indicating whether the transaction is approved or declined.

7. - The card association relays this response to the merchant’s payment processor.

8. - The payment processor relays this response to the payment gateway.

9. - The payment gateway informs both the customer and the merchant of the response.

|

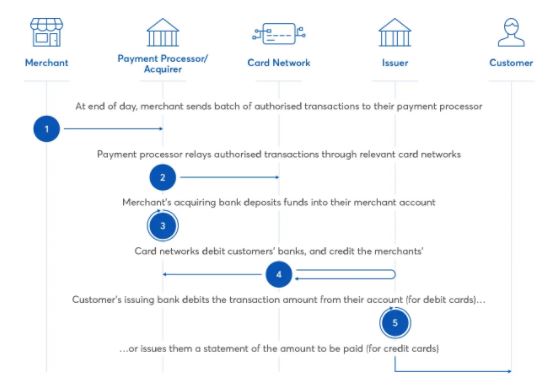

|

1. - At the end of the day, the merchant sends a batch of all authorised transactions from that day to their payment processor.

2. - The payment processor relays these authorised transactions through the relevant card associations.

3. - The merchant’s acquiring bank deposits funds totaling the transaction amounts into their merchant account (deducting any relevant fees).

4. - The card associations (from step 2) debit the customers’ issuing banks for the relevant transaction amounts, then credit the merchants’ acquiring banks (deducting any relevant fees).

5. - The customer’s issuing bank debits the relevant transaction amount from their account (for debit cards), or issues them a statement requesting the amount be paid (for credit cards).

|

- The customer begins a payment or a refund.

- The merchant redirects the customer to an app-hosted page to begin their payment or refund.

- The payment or refund takes place on the payments app, which is hosted on the app-hosted page.

- The app performs app-specific operations during the payment.

- The app records the payment in Shopify admin.

https://gocardless.com/guides/online-payments-guide/online-payments-credit-debit-card/

https://gocardless.com/guides/posts/payment-gateways/

https://gocardless.com/guides/thank-you/consumer-payment-preferences-2021/

https://store.magenest.com/blog/merchant-account/

https://www.cardswitcher.co.uk/what-is-a-merchant-account/

https://woodridgesoftware.com/e-commerce-overview/

https://hanfincal.com/different-types-of-credit-cards/

Đang xử lý....

Đang xử lý.... Đang xử lý....

Đang xử lý....